nebraska vehicle tax calculator

If you are not a Nebraskagov subscriber sign up. If you are unsure call any local car dealership and ask for the tax rate.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

. The documentation fee is set by the dealer but is not negotiable so clarify upfront what the dealer charges. The nebraska income tax calculator is designed to provide a salary example with salary deductions made in nebraska. In Nebraska the sale of cars is subject to a sales tax like for most other states.

A 100 fee is charged for each successful Nebraska Title Lien and Registration Record Search. Nebraska vehicle tax calculator. Nebraskas motor vehicle tax and fee system was implemented in 1998.

The tax commissioner assigned a value. Vehicle Information required Motor Vehicle Tax calculations are based on the MSRP Manufacturers Suggested Retail Price of the vehicle. These fees are separate from.

Motor Vehicle and Registration fees are based on the value weight and use of the vehicle. 5 of the sale price of a car is taxed in Nebraska. Before that citizens paid a state property tax levied annually at registration time.

Buying a car in Nebraska is subject to a vehicle sales tax like most other states. Registering a recently-purchased vehicle will involve paying state and local sales tax in addition to registration and possible plate fees. View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator.

Online Calculators Financial Calculators Nebraska Car Loan Calculator Nebraska Auto Loan Calculator. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. Before that citizens paid a state property tax levied annually at registration time.

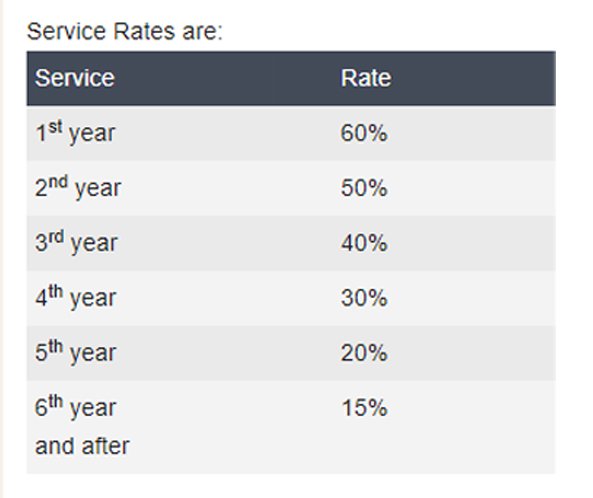

The percentage of the Base Tax applied is reduced as the vehicle ages. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. If you are registering a motorboat contact the Nebraska Game and Parks Commission.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. These fees are separate from. If you make 70000 a year living in the region of Nebraska USA you will be taxed 11756.

Online estimates are not available for vehicles over 14 years old. This service is intended for qualified business professional use only to view vehicle title lien and registration information. Nebraska vehicle tax calculator.

Nebraska Documentation Fees. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. The MSRP on a vehicle is set by the manufacturer and can never be changed.

Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. How Does Nebraska Calculate Motor Vehicle Tax. The car or motor vehicle tax in Nebraska can be overwhelming since they are actually several taxes rolled together to pay for one very expensive little sticker on your license plate.

Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

DMV fees are about 765 on a 39750 vehicle based on a percentage of the vehicles value. The documentation fee is set by the dealer but is not negotiable so clarify upfront what the dealer charges. Nebraska vehicle tax calculator.

The registration fee in New England is 15. When you register your car you must pay 15 for state registration fees. It is 15 to register your car in Nebraska located in the United.

Sales tax on cars is 5 in Nebraska. This sales tax funds a wide range of projects and programs run by the state. These sales taxes fund a vast range of projects and programs throughout the state.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. Nebraska Income Tax Calculator 2021. Nebraska Auto loan calculator is a car payment calculator with trade in taxes extra payment and down payment to calculate your monthly car paymentsNebraska car payment calculator with amortization to give a monthly breakdown of the principal and interest that you.

January 31 2022 by Molly. 2000 century 2100 boat for sale. Your purchase will be charged to your Nebraskagov subscriber account.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Title Vs Registration What S The Difference Rategenius

Vehicle And Boat Registration Renewal Nebraska Dmv

California Vehicle Sales Tax Fees Calculator

Best Car Insurance Companies Of April 2022 Forbes Advisor

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Dmv Fees By State Usa Manual Car Registration Calculator

Car Loan Amortization Calculator With Auto Amortization Schedules

Dmv Fees By State Usa Manual Car Registration Calculator

Find Out If You Have To Pay Import Tax When Shipping A Car To The Usa And How Much It Costs As Well As Information On Exemptions Gas Guzzler Tax And More

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

How To Calculate Your Ev Cost Per Mile Corporate Monkey Cpa

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

What S The Car Sales Tax In Each State Find The Best Car Price