oklahoma franchise tax payment

If tax is paid over 30 days after the due date a 10 percent penalty is assessed. If tax is paid 1-30 days after the due date a 5 percent penalty is assessed.

Individual Income Tax Oklahoma Policy Institute

Indicate this amount on line 13 of the Form 512 page 6.

. If you elected to change your filing date to be the same as the date of filing your corporate income tax the report and tax will be delinquent. How is franchise tax calculated. Foreign corporations are not obliged to pay the Oklahoma franchise tax but are still liable for the 100 registered agent fee.

EFT and electronic filing are designed to move tax payments and reports faster. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. The maximum annual franchise tax is 2000000.

If filing a consolidated franchise tax return for oklahoma the oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Indicate this amount on line 13 of the Form 512-S page 6. Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications Exemption Letters All Taxes Income - Individual Income - Businesses.

Once you have access to your Cigarette Wholesale account on OkTAP you can order stamps. FISCAL YEAR AND SHORT PERIOD RETURNS. Years ago Oklahoma temporarily replaced the franchise tax with a so-called business activity tax BAT.

Only those corporations with capital of 20100000 or more are required to. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Corporations that remitted the maximum amount of franchise tax for the preceding tax year do not qualify to file a combined income and franchise tax return.

The report and tax will be delinquent if not paid on or before September 15. The franchise tax is assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital allocated invested or employed in Oklahoma with a 250 minimum tax and 20000 maximum tax. Oklahoma Franchise Tax is due and payable July 1st of each year or if you elected to change your filing date to be the same as the date of filing your corporate income tax the report and tax will be delinquent if not paid by the fifteenth 15 day of the third month following the.

The Oklahoma Tax Commission has also developed two methods of electronically filing certain tax returns. The maximum annual franchise tax is 2000000. The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma.

And interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. A ten percent 10 penalty and one and one-fourth percent 125 interest. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200.

Internet filing and IVR Telefile. In Oklahoma the maximum amount of franchise tax a corporation can pay is 20000. Only those corporations with capital of 20100000 or more are required to remit the franchise tax.

Your session has expired. Oklahoma Franchise Tax Payment. A ten percent 10 penalty and one and one-fourth percent 125 interest.

Foreign corporations are not obliged to pay the Oklahoma franchise tax but are still liable for the 100 registered agent fee. Due is income tax franchise tax or both. The report and tax will be delinquent if not paid on or before September 15.

However it can also offer you a number of benefits. EF-V 2 0 2 FORM 0 Address City State ZIP Daytime Phone Number Federal Employer Identification Number Balance Due Amount of Payment Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890 Do not enclose a copy of your Oklahoma tax. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax.

Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with. A 50 penalty is assessed on each report filed after the due date. Oklahoma Franchise Tax is due and payable July 1st of each year.

Individual filers completing Form 511 or 511NR should use Form 511-V. These programs are intended to provide a paperless system of tax reporting. Click the Pay Now button to pay for the stamp order.

Corporations reporting zero franchise tax liability must still file an annual return. The maximum amount of franchise tax that a corporation may pay is 2000000. The report and tax will be delinquent if not paid on or before August 31.

How is franchise tax calculated. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. Oklahoma Franchise Tax is due and payable July 1st of each year.

Click the Order Cigarette Stamps link on the sidebar and complete the order form. In Oklahoma the maximum amount of franchise tax a corporation can pay is 20000. Returns should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800.

Click the continue arrow at the bottom of the screen to navigate to the payment window. Corporations that remitted the maximum amount of franchise tax for the preceding tax year do not qualify to file a combined income and franchise tax return. You will be automatically redirected to the home page or you may click below to return immediately.

We would like to show you a description here but the site wont allow us.

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Oklahoma Tax Commission Linkedin

South Carolina Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

Oklahoma Tax Forms 2021 Printable State Ok 511 Form And Ok 511 Instructions

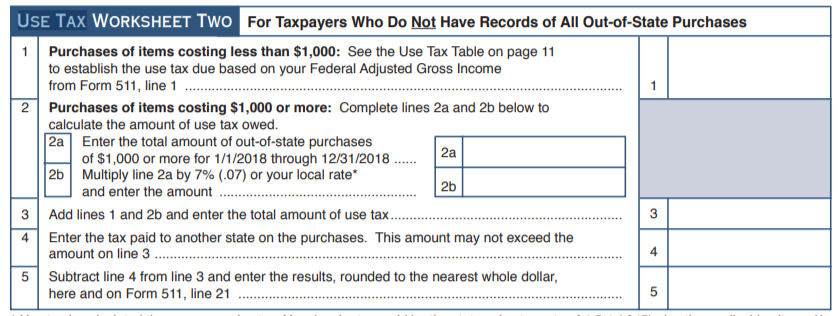

Do I Owe Oklahoma Use Tax Support

Oklahoma Social Studies Unit No Prep Oklahoma Flag Oklahoma State Flag Oklahoma

Top 1 Pay Nearly Half Of Federal Income Taxes Income Tax Federal Income Tax Income

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Irs Federal Income Tax

Oklahoma State And Local Taxburden Combined Industries Manufacturing Utilities Educational Services And Art Entertainmen Educational Service Burden Tax

How To Get And Read Your W 2 Form Life Skills Employment Income Tax

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

Oklahoma Taxpayer Access Point

State And Federal Eitc Benefits Pay Off For Lower Wage Workers Plus Starting This Week Bonus Tips In The Daily Tax Tips Weekly Roundup Tax Tax Credits Worker

Oklahoma S Income Tax By The Numbers Oklahoma Council Of Public Affairs